Venture capital firms manage large amounts of capital investments in startups and emerging companies. With hundreds or even thousands of portfolio companies to track, it can be a daunting task for venture capitalists to manage and monitor their investments. That's where venture capital software comes in – a comprehensive tool that helps firms to manage their portfolio companies, track performance, and make data-driven investment decisions. In this article, we'll explore the benefits of venture capital software and how it can help firms manage their portfolio with ease.

Benefits of Venture Capital Software

- Portfolio management: Venture capital software provides a centralized platform for managing portfolio companies. It enables VC firms to track and monitor investments, analyze performance metrics, and identify potential risks and opportunities.

- Due diligence: The due diligence process is crucial for venture capitalists when evaluating potential investments. VC software can streamline the due diligence process, providing easy access to company information, financials, legal documents, and other relevant data.

- Deal flow management: VC firms receive a large volume of potential investment opportunities, and it can be challenging to sort through them all. VC software can help automate deal flow management, prioritizing opportunities based on the firm's investment criteria.

- Communication and collaboration: VC software can improve communication and collaboration within the firm and with portfolio companies. It provides a centralized platform for sharing information, tracking progress, and collaborating on tasks.

- Reporting and analytics: Venture capital software provides robust reporting and analytics capabilities, giving firms insights into their portfolio performance, investment trends, and potential risks.

How Venture Capital Software Can Help Manage Your Portfolio

- Streamline portfolio management: With venture capital software, VC firms can manage their portfolio companies more efficiently. They can track financials, monitor performance metrics, and receive alerts for potential issues.

- Track deal flow: VC software can help firms keep track of potential investment opportunities, automate deal flow management, and prioritize opportunities based on investment criteria.

- Manage due diligence: VC software can streamline the due diligence process, enabling firms to access relevant data and information quickly.

- Improve communication and collaboration: VC software provides a centralized platform for communication and collaboration within the firm and with portfolio companies. It can help streamline workflows, track progress, and improve collaboration.

- Make data-driven decisions: With robust reporting and analytics capabilities, VC software can help firms make data-driven investment decisions. It provides insights into portfolio performance, investment trends, and potential risks.

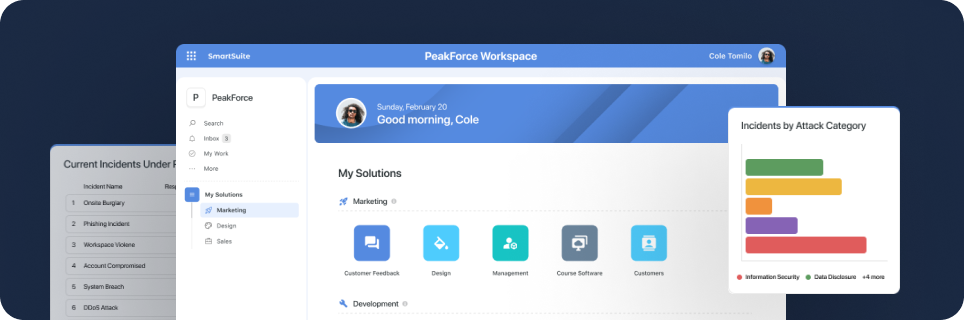

SmartSuite's Venture Capital Solutions

SmartSuite offers a comprehensive venture capital solution that helps firms manage their portfolio with ease. Our solution provides a centralized platform for managing portfolio companies, tracking performance metrics, and automating deal flow management. It also streamlines due diligence and improves communication and collaboration within the firm and with portfolio companies. With SmartSuite's venture capital software, firms can make data-driven investment decisions, streamline workflows, and manage their portfolio more efficiently.

Venture capital software is essential for VC firms looking to manage large amounts of capital investments in startups and emerging companies. It provides a comprehensive solution for managing portfolio companies, tracking performance, and making data-driven investment decisions. SmartSuite's venture capital solution offers a powerful tool for managing your portfolio with ease. With SmartSuite, VC firms can streamline workflows, track deal flow, and make informed investment decisions.

Run your entire business on a single platform and stop paying for dozens of apps

- Manage Your Workflows on a Single Platform

- Empower Team Collaboration

- Trusted by 5,000+ Businesses Worldwide