One big question [in the averted port strike] was about automation versus long-term roles. Warehouses owned and managed single companies – each having varied interests, makes it tough. But digitization and infrastructure investment will certainly be the biggest thing over the next two, three, and four decades.

Going mainstream: The logistics industry has never loomed so large in the mainstream public consciousness as it has in recent months. The narrow miss of a major port strike in October, and the threat of another strike lingering has experts on the lookout. Beyond that, the holiday season is approaching fast and consumer expectations are higher than ever.

"What's different this year is that goods were shipped earlier than usual in part because of concerns people had with the potential port strike and longer shipping times due to like the Red Sea avoidance," says Vizion CEO Kyle Henderson, speaking about how shipping infrastructure providers are approaching the upcoming holiday rush.

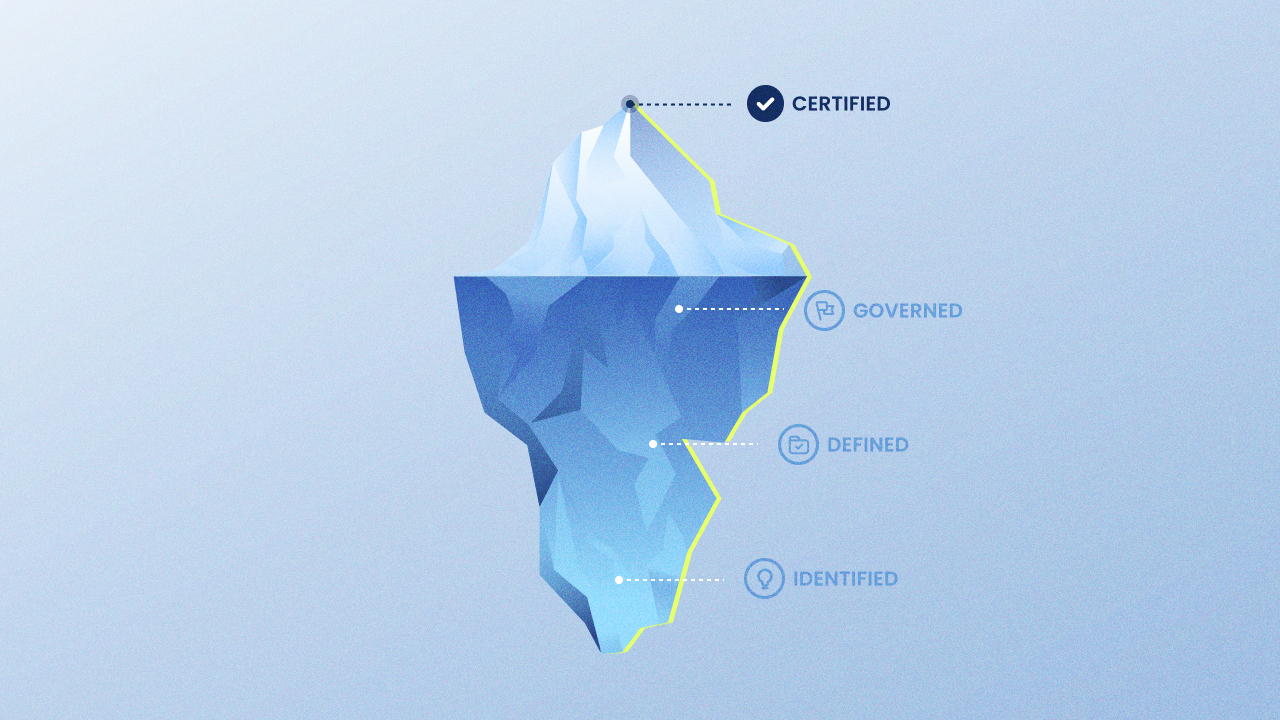

Vizion is a logistics technology company that provides visibility solutions for containerized freight, including real-time tracking and global trade intelligence data. The company provides comprehensive visibility by combining shipment updates with rich insights to improve supply chain resilience.

Data insights: The ability to track and analyze freight movements with precision is becoming a critical differentiator in global trade logistics in a time when retail is more competitive than ever. The winners in the space are leveraging comprehensive data insights to connect disparate systems to optimize supply chain operations. But the challenge is balancing the sheer volume of data with actionable intelligence delivered in a timely manner.

- "We see [trade booking data] three to four months before delivery is complete, whereas competitors may only provide it one to thirty days out," says Henderson.

KH on the breadth of Vizion's vision: "We make sense of the performance of logistics globally, down to individual vessels and company supply chains." Vizion can provide insights into suppliers and dependencies between companies across different supply chains. It's like having a crystal ball to surface logistics data insights at every stage of the cargo journey. "We can tell you what cargo is on what vessel and where it is in the world, and exactly what products companies have booked to ship next quarter," Henderson says.

What's different this year is that goods were shipped earlier than usual in part because of concerns people had with the potential port strike and longer shipping times due to like the Red Sea avoidance.

KH on typical seasonal shipping patterns: "It's getting quieter now because we're post-peak season, and there's usually a lull from November to January...The next big seasonal push starts in late Q1 or early Q2 as summer shopping inventory gets moved."

KH on the impact of early shipping on consumer sales: Early shipping due to concerns over port strikes and longer shipping times may lead to less concentrated sales during traditional shopping events like Black Friday and Cyber Monday.

- "To insure against these situations, companies shipped inventory earlier in the peak season than in past years. For consumers, this means less concentrated sales during hot windows, and sales for the holiday season are likely stretched out over September, October, or November because the inventory was ready to sell."

Looking ahead: Dockworker job concerns notwithstanding, automation and more AI in shipping is inevitable, which will thus create new job roles requiring technological know-how. "One big question [in the averted port strike] was about automation versus long-term roles," says Henderson. "Warehouses owned and managed single companies – each having varied interests, makes it tough. But digitization and infrastructure investment will certainly be the biggest thing over the next two, three, and four decades."